As received on Whatsapp - would love to credit the creator

Our Finance Minister reduced the burden of personal income tax.

This is highly welcomed, and will save Indian citizens about 1 trillion rupees a year, somewhere between 0.3 and 0.4% of GDP.

Since she plans to reduce the fiscal deficit, the tax cut will mean lower government expenditure, and - all other things being equal - no additional pressure on inflation.

Also to be welcomed.

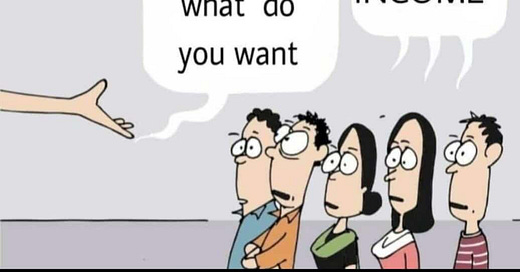

Good moves, but far too timid - our growth is sagging, and the folks who are worst hit by the lack of opportunity are those who do not pay taxes at all. They will derive no direct benefit from budget measures, and I guess the FM and her advisers believe that the dynamic will work like this:

More post-tax income for middle-class:

More discretionary expenditure:

More demand for goods and services:

More employment:

More income for the poor.

The chain is logical, but it is not clear how strong the linkages are:

How much of the additional income will be saved?

How much of the additional demand will translate into jobs?

The last link is the weakest, as the formal manufacturing sector has demonstrated its ability to grow output much faster than employment.

Still, the budget measures are better than a slap in the face, as an English colleague used to say.

The other highly welcome step is a committee to reduce unnecessary regulation of enterprise. Desperately needed. Sorry to be the sceptic here, but I think of the late Bibek Debroy, who did deep work on laws that need to pushed over the cliff, into an eternal sunset. Nothing happened.

This reminds me of the English management thinker, C. Northcote Parkinson, who said about government committees:

“ A government committee is like a visit to the lavatory.

First there is a sitting.

Then there is a report

Then the matter is dropped.”

Very sharp Mohit! And thanks for bookending a serious piece with laughs :) Having recently started working inside govt, I am particularly amused!

"... a visit to the lavatory", indeed